Venture capital dollars flowing to US digital health continued to surge in Q3 2020. One thing is for sure—2020 will be the largest funding year ever for digital health, spurred by 24 mega deals so far. Moreover, the stock market’s sharp recovery and pandemic-initiated policy and regulation changes have enabled large competitive moves and commercialization activities.

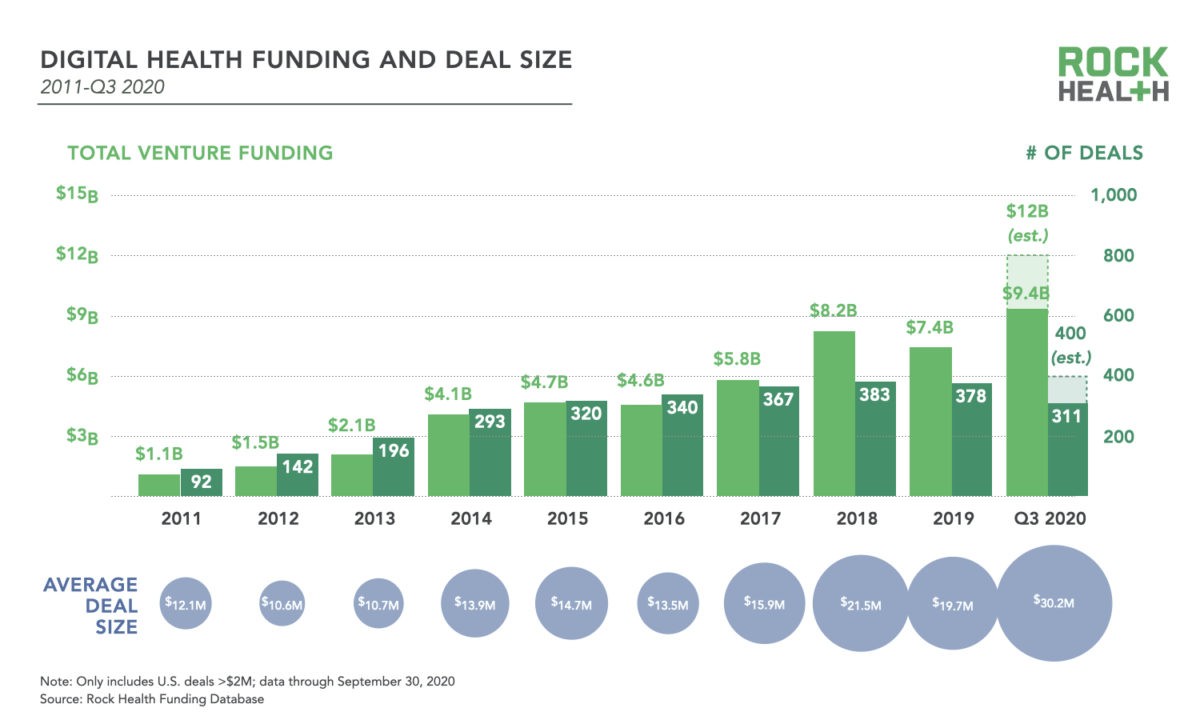

Here’s one more way 2020 is unlike any other year: it is already the largest funding year ever for digital health. The $4.0B invested in US-based digital health startups through Q3 brings the year’s running total to $9.4B, far exceeding what used to be the largest annual sum of $8.2B in 2018. At least $2.4B has been invested each quarter this year—consistently above the quarterly average of $2.1B across 2018-2019.

And even more so than in recent years, large deals are driving the top-line numbers. The average deal size in 2020 is $30.2M, 1.5 times greater than the $19.7M average in 2019.

FITNESS & WELLNESS

Supports general health maintenance and promotion, including fitness, nutrition, and sleep

Mega deals are on the rise—particularly in virtual care delivery, R&D enablement, and fitness & wellness

Twenty-four (24) digital health companies have raised mega deals of $100M or more through Q3 of 20201. This already doubles the previous annual record of 12 mega deals set in 2018. Mega deals account for well over one-third (41%) of total digital health funding so far this year with connected fitness company Zwift raising the largest round so far—$450M in Series C funding.

WHAT IS DIGITAL HEALTH?

Rock Health defines digital health as the intersection of healthcare and technology. This means that the venture funding tracked only includes technology-enabled health-related companies, whether they focus on the administration of healthcare, the delivery of healthcare, or the process of bringing breakthrough new healthcare products to market (both R&D and commercialization).

Corporate investors double down on digital health

Amidst the volatility of 2020, the investor mix in digital health has remained refreshingly consistent. Sixty-four percent (64%) of this year’s investors have previously made investments in digital health—higher than any previous year. Institutional venture firms continue to account for the largest share of transactions (62%), with corporate venture capital (CVC) holding steady at 15% of transactions. 7

CVC has always been an integral part of the digital health funding landscape. Enterprise organizations offer their portfolio companies buy-side perspective and, in some cases, commercialization opportunities. So when COVID-19 hit the US, there were concerns that the financial impact and diversion of resources to address COVID-related imperatives might result in a broad contraction in CVC venture investment. That certainly isn’t how it’s played out in 2020 in digital health, or in other industries.

Corporate investors have made 149 investments in digital health across three quarters this year, which already exceeds the previous record of 145 investments across all of 2017. Quarterly investments by the four most active CVC groups—providers, technology companies,8 biopharma, and payers—are all trending upwards over the last 12 months. Provider CVCs lead the way with at least 12 investments per quarter in each of the last three quarters. Such sustained investment activity is remarkable given the fact that so many provider organizations have been in crisis-response mode preparing for and reacting to COVID-19 outbreaks in their regions.

Technology companies and biopharma have substantially increased their investment activity in digital health over the past 12 months. Technology companies’ quarterly deal count climbed steadily across the COVID-19 pandemic, from three in Q4 2019 to 17 in Q3 2020. Biopharma’s deal count jumped from an average of 2.5 investments per quarter across Q4 2019-Q1 2020 to an average of 12.5 investments per quarter across Q2-Q3 2020.

Where do we go from here?

The strength of 2020 investment to date matches this moment of unparalleled demand and opportunity for digital health. Our optimism for tech-driven transformation is reinforced by the legitimization of business models, demonstration of strong clinical and economic outcomes, increasing FDA clearances and approvals, and industry efforts to develop scalable payment mechanisms for digital health products. However, we are just on the cusp of this momentum. As the pandemic continues to unfold, we are eager to see the industry come together to cement advancements already made this year, and continue on this trajectory.

(Source: Rock Health)